If you were going to climb Mt Everest, would you use a guide? Your journey to, and through, retirement is very much like a mountain expedition.

At Hood Financial, we use this analogy to communicate our process, services, and values in a unique, visual, and memorable way.

Discover how a skilled and trusted Retirement “Sherpa” can help to guide you safely on your journey!

About Hood Financial

Welcome! As a Financial Adviser, fiduciary, and qualified Retirement “Sherpa” in San Diego, CA, I specialize in helping our clients with Retirement Planning, Investment Management, and Financial Planning.

Our mission is to help our clients create a plan for their future that helps them feel more confident, secure, and in control of their finances. If you would like some guidance with Retirement Planning, Investment Management, or Financial Planning, please contact our office today.

Ask Us A Question

About Hood Financial

You’re busy. We get it. At Hood Financial, we know that time is your most precious commodity- not money. With so many people and things competing for your time and attention, it’s no wonder that family, faith, fitness, friends, and fun often takes precedence over planning, pie charts, and portfolios. We also understand that not all advisers and firms are created equal. Knowing who to trust can be difficult, but not impossible. Do you go with a big-name national firm or a smaller local group? There are many other questions you must consider and yes, it does take a little bit of time, effort, and doing your homework. So, why choose to work with Hood Financial over anyone else?

Click below to find out!

Your Map

It all begins with a map, or plan, detailing the path you will follow to achieve your goals before retirement and beyond.

Your Gear

We make sure you are equipped with the right mix of investments, strategies, and financial tools to support you throughout the journey.

Your Guide

As your Financial “Sherpa”, we stay with you from beginning to end, ensuring that you stay on the right path and are prepared for life’s surprises.

What We Do

Retirement planning is similar to planning for a mountain expedition. You reach the “summit” when you leave work, and the trip down the mountain is fraught with just as much difficulty and danger (if not more) as on the way up. Our job is to make sure you are properly trained and equipped—and that you know what to expect at every stage.

Ready to start the conversation?

We’re here to help you understand the most important questions you should be asking. Take the first step today.

Sign up for a Complimentary Consultation and Book

SIGN UP TO RECEIVE YOUR FREE COPY

Recent News

7 Smart Strategies to Pay Off Your Mortgage Ahead of Schedule

You as a homeowner may strive ...

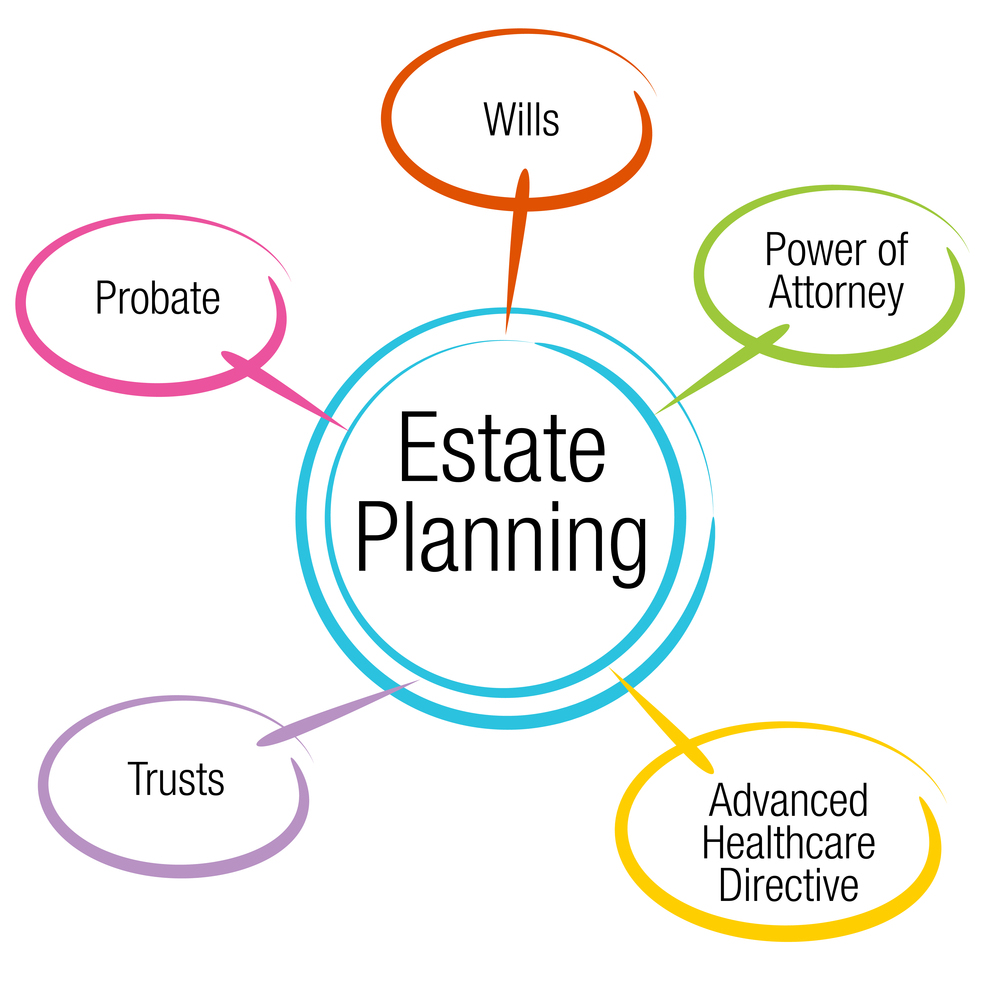

Read morePlanning for the Future: Estate Planning for Young Families

Traditionally associated with ...

Read moreHow to Prep Your Finances for a Last-Minute Summer Vacation

Summer vacation is a time of ...

Read moreNational Financial Freedom Day: A Celebration of Financial Responsibility

National Financial Freedom ...

Read moreSmart Money Moves: Financial Tips for Building Your Vacation Fund

An escapade to an exotic ...

Read moreBudding startups: Tips for Entrepreneurs Before Launching Their Idea

Launching a budding startup ...

Read moreSpring Cleaning Your Finances: How to Declutter Your Financial Life

As we welcome the spring ...

Read more